The collapse of two billion USD and the fragility of the cryptocurrency world

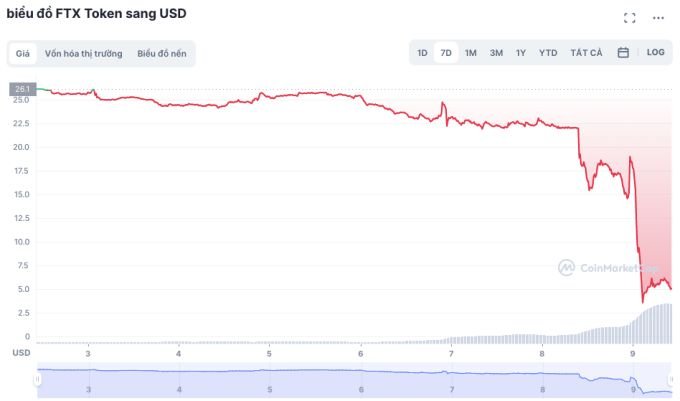

On November 8, the FTT token of the FTX cryptocurrency exchange was still trading at 22 USD per coin.

The sell-off wiped out more than $2 billion in FTT’s market capitalization.

Meanwhile, FTX floor owner Sam Bankman-Fried (SBF) also lost 94% of his assets, from nearly 16 billion USD to 991.5 million USD in one day and is no longer on Bloomberg’s billionaires ranking.

FTT token fall.

The incident started with a `war of words` between Sam Bankman-Fried, CEO of FTX, and Changpeng Zhao (CZ), CEO of Binance, on the morning of November 6.

Things got worse when CZ posted a message on Twitter that `FTX asks for help` after `there is a significant liquidity crisis underway`.

This announcement initially helped the FTT token price increase from 22 USD to 24 USD, but then dropped sharply.

Before FTT plunged, CZ warned on Twitter that the token would be `highly volatile in the coming days`.

FTX is the third largest cryptocurrency exchange after Binance and Coinbase, according to data from Coinmarketcap.

Fragility in the world of cryptocurrency

Not only is it one of the three largest cryptocurrency exchanges in the world, FTX is also considered an exchange on the rise, valued at 32 billion USD in January. The exchange has also spent billions of dollars to acquire companies.

Therefore, the fact that FTX suddenly went down due to a `liquidity crisis` and was about to go to Binance – the exchange’s biggest competitor – was surprising.

Meanwhile, WSJ assessed that the deal signals a shift in power in the cryptocurrency world.

The current problem of FTX, with the decline of FTT, shows the fragility and instability of the cryptocurrency market, which is under intense scrutiny from investors and regulators.

According to WSJ, the failure of one of the world’s leading cryptocurrency companies is a blow to the reputation of this ecosystem.